New Articles

-

AI三大瓶颈及其10个“傻白”和5个“傻精” 2026/02/04

AI三大瓶颈及其10个“傻白”和5个“傻精” 2026/02/04AI三大瓶颈及其10个“傻白”和5个“傻精”The Three Major Bottlenecks of AI and Its “10 Naïve Blind Spots” and “5 Cunnin...

-

共生场图灵测试 (SFTT)的设计 2026/02/03

共生场图灵测试 (SFTT)的设计 2026/02/03共生场图灵测试 (SFTT)的设计Symbiotic Field Turing Test (SFTT) Design 本报告根据Google AI与Archer宏2...

-

沃什、马斯克与钱宏 GDE 体系:把握宏观不确... 2026/02/02

沃什、马斯克与钱宏 GDE 体系:把握宏观不确... 2026/02/02沃什、马斯克与钱宏 GDE 体系:把握宏观不确定性的范式革命 Warsh, Musk, and Hong Qian's GDE System: A Paradigm ...

-

从 GDP 到 GDE——如何切断“规模—外汇—互害”的... 2026/02/02

从 GDP 到 GDE——如何切断“规模—外汇—互害”的... 2026/02/02从 GDP 到 GDEFrom GDP to GDE——如何切断“规模—外汇—互害”的制度循环?How to Cut the Institutional Loop of “S...

共生思想理论前沿

THE THEORY

-

-

-

-

关于中文“共生”翻译及对应的人、事、物之说明

关于中文“共生”翻译及对应的人、事、物之说明关于中文“共生”翻译及对应的人、事、物之说明 ——Symbiosism:Charles Thomas Taylor &Qian hong又一次量子缠绕...

查看详细说明

Speech

-

三大自组织货币的共生格局——宏观世界之数字货币 2021/07/08

三大自组织货币的共生格局——宏观世界之数字货币 2021/07/08三大自组织货币的共生格局 ——宏观世界之数字货币 钱 宏 The Institute for Global Symbiosism(...

-

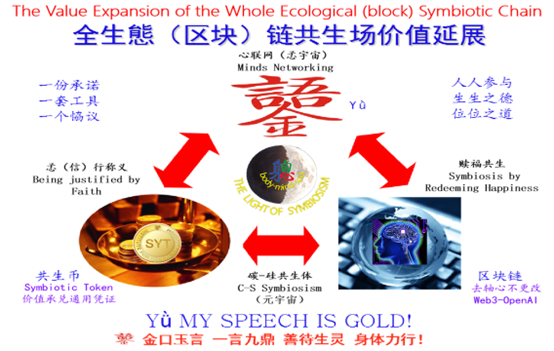

新汉字yǜ的释义 2019/11/16

新汉字yǜ的释义 2019/11/16语从金音玉(Yǜ):金口玉言,一诺千金,性人诚恳、执信; &n...

-

钱宏:中国的真实经验与未来走向(凤凰博报专... 2019/11/16

钱宏:中国的真实经验与未来走向(凤凰博报专... 2019/11/16点击播放 中国的真实经验与未来走向《凤凰博报》专访钱宏主持人:...

《欧美石化协议》与全球货币体系的未来

发布时间:2025/03/13 公司新闻 浏览次数:171

The U.S.-Europe Petrochemical Agreement and the Future of the Global Monetary System

《欧美石化协议》与全球货币体系的未来

By Archer Hong Qian

新闻:拜登在俄罗斯侵略乌克兰之后达到了的紧急令,允许俄罗斯能源银行纠正,为方便欧洲各国采购俄罗斯能源时的付款。紧急紧急于今天中午2025年3月12日开始。川普刚刚拒绝了欧盟国家对这项紧急协议的请求:3月12日起,欧洲不再能够合法购买俄罗斯的石油和天然气来资助资助的战争机器了。

但是,石化能源毕竟是欧洲的刚需,俄罗斯断油、断气之后,谁来填补空白?当然是美国,或者说北美!这就是我为什么提出签订《欧美石化协议》建议的原因之一。

而且,今天一早醒来,我就想:《乌美矿产协议》只是一种局部谋略,远不具备战略意义!当然,这也是无奈之举,包括那个拜登签署延长的“俄罗斯金融机构包括俄罗斯中央银行进行能源交易许可证”(美东3月12日到期),也是一种无奈的谋略!

大国不尚谋略,基于融入多重战略、战术、谋略、策略的大战略思维,我想,灯塔美丽国总统:最好是在签订《欧美石化协议》基础上,重启并扩充《环大西洋公约》(Transatlantic Trade and Investment Partnership,TTIP)谈判,这样,就和“印太战略”连接起来,再加入《全面与进步跨太平洋伙伴关系协定》(Comprehensive and Progressive Agreement for Trans-Pacific Partnership,简称CPTPP),便形成一个完全不同于联合国安全框架的真正的有效率而公义的“全球性经济安全架构”就建立起来了! https://x.com/messages/media/1900386154362634427

现在,我想接着《从<乌美矿产协议>绑定,到<欧美石化协议>开局——美国总统遭遇了一个哈姆雷特王子式难题!怎么办?》,单独谈谈与此相关的“全球货币体系的未来”。

欧美石化协议:巩固美元储备货币地位的重要一环

《欧美石化协议》不仅是川普政府能源战略的高效展开,更是兑现其20项核心承诺之一——即“保持美元作为世界储备货币的国际地位”的重要支柱。

这项协议涵盖能源、原材料和国际结算,必然会对美元的全球储备货币地位产生深远影响。长期以来,石油和大宗商品交易一直是美元全球霸权的支柱。通过这一协议,美国将在全球能源贸易中强化美元的主导结算地位,这正契合川普政府的承诺,即确保美元继续占据全球金融体系的核心。

欧美石化协议与“去美元化”迷思

近年来,“去美元化”被一些国家和媒体炒作为全球趋势,然而这实际上是一个被放大的伪命题。全球经济的本质在于效率和信任,而当前,美元仍然是全球流动性最强、信用最稳定、制度最健全的货币。

即便一些国家尝试推动本币结算或建立区域性货币联盟,这些举措更多是基于贸易便利性和短期风险对冲的需求,而非真正意图取代美元。《欧美石化协议》的实施,将进一步证明美元在国际贸易和金融体系中不可撼动的地位,并削弱“去美元化”声音的影响力。

川普政府强调“保持美元作为世界储备货币”,并非单纯依赖金融霸权,而是基于美元在全球经济中的交互主体地位。美元不仅仅是一个货币单位,它已经与全球资源、技术、市场、交易、规则深度绑定。《欧美石化协议》如果成功落地,将进一步强化美元在全球能源定价和结算体系中的核心地位,使其成为全球金融生态不可替代的稳定器。

超主权货币与全球金融生态的交互演进

十年前,我曾在《试论超主权货币的哲学-经济学基础——一切皆为约定:共生权-共生币-共生链》一文中,探讨了2009年伦敦G20峰会前夕,俄罗斯政府和中国央行行长周小川分别提出的“超国家储备货币”(Super-national reserve currency)和“超主权储备货币”(Super-sovereign reserve currency)的构想。

虽然这些概念并未成为解决全球经济问题的现实方案,但它们揭示了一个真正的开放性议题:

在“产业链、供应链、价值链”的全球交互共生趋势推动下,未来的世界规则将趋向“零关税、零壁垒、零歧视”,超主权储备货币的设想,反映了高度公平性、客观性和交互性的全球金融需求,并具有极大的公约性和公信力。

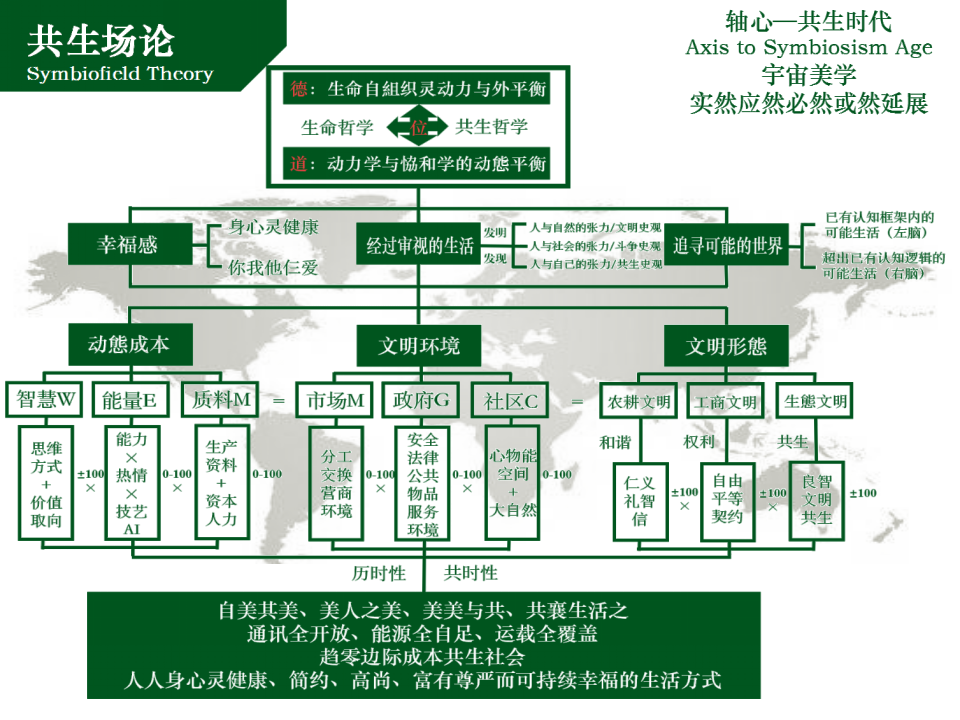

基于此,我提出:所有国际化的货币,包括数字货币、加密货币、稳定币,本质上都是“共生币”(Symbiotic Token)的概念。

这一概念不仅为未来的货币体系提供了新的评判标准,也预见了数字货币、加密货币和稳定币在全球经济中的共生关系,强调了不同类型的数字资产在共享基础设施和金融生态系统中的交互协同作用。

数字货币、加密货币与共生币的演进

在区块链领域,货币形式可分为原生币和代币:

✅ 原生币(Native Coins)——如 比特币(BTC)、以太坊(ETH)、泰达币(USDT)、币安币(BNB)、索拉纳(SOL)、狗狗币(DOGE)、美元币(USDC)、瑞波币(XRP)、波场币(TRX)等,作为区块链网络的基础货币,主要用于交易和价值存储。

✅ 代币(Tokens)——基于区块链平台,通过智能合约创建,服务于特定应用、去中心化金融(DeFi)、NFT市场等。

近年来,随着区块链技术的成熟,全球主要企业开始整合加密货币支付系统,提高交易效率,同时,随着各国Trust监管框架的完善——逐步过渡到“愛之智慧孞態网”(Amorsophia MindsNetworking),也正在为加密货币市场带来更高的稳定性和合法性。

共生币在孞態网(MindsNetworking)基础设施中的价值机制

随着孞態网(MindsNetworking)技术伦理基础设施的逐步建立,共生币不仅是金融交易的工具,更将承载良善或邪恶孞念价值奖惩机制的核心角色。在这一体系下,共生币可以成为奖抑“一念天堂,一念地狱”(One Mind Heaven,one Mind Hell)机制:

✅ 激励良善行为——通过透明化、可追踪的机制,对推动社会共生、科技伦理和生态可持续发展的行为给予正向奖励。

✅ 抑制邪恶孞念——构建一个基于集体智慧评估的共生信用体系,使任何试图破坏社会共生、滥用金融系统或技术伦理的行为受到相应制约。

✅ 优化全球信任体系——在孞態网基础设施的支持下,共生币将在全球范围内形成一个更加公开、公正、可信的信用体系,推动人类社会的健康发展。

共生币、传统货币与全球金融体系的未来

将所有上述货币形式视为“共生币”,强调了它们在全球金融体系中的相互依存的共生关系。传统国际化货币的信用稳定性和独立管理,为数字货币提供了价值基础,数字货币为金融创新和包容性金融提供了新路径,稳定币则在两者之间架起桥梁。这种交互主体共生態势推动了全球金融生态的持续演进。

✅ 传统国际化货币的信用稳定性——美元、欧元等法定货币的核心价值在于高度信用稳定性和独立管理机制,确保了货币政策的稳定性,这也是美元全球储备货币地位的根本。

✅ 数字货币与传统货币的共生关系——加密货币依赖法定货币的计价体系,其稳定性与流动性仍然受传统金融体系的影响。

✅ 稳定币的桥梁作用——如 USDT(泰达币),通过1:1锚定美元,在加密货币市场中提供稳定的交易媒介,促进传统金融与数字资产的融合。

✅ 共生币的未来趋势——未来的全球货币体系将更加去中心化、多元化、透明化,实现传统货币、数字货币、稳定币、代币交互主体共生的价值承兑关键凭证。

因此,欧美石化协议的落地,不仅关乎美元的储备货币地位,还将进一步推动全球金融体系进入一个共生演化的新时代。更重要的是,在孞態网(MindsNetworking)技术伦理基础设施建成后,共生币将不仅是经济工具,更是取代现行诸多显赫Trust(如政府、银行)组织平台,成为监督和推动愛之智慧、社会正义、技术伦理和人类交互主体共生生活方式的可靠媒介。

2025年3月9日深夜于Vancouver

什么是比特币?

比特币于2009年以化名中本聪(Satoshi Nakamoto)创立,是一种仅在网上交易的数字货币。它使用一种名为区块链的技术,允许每笔比特币交易存储在全球数千台计算机上,被称为“公共记录”,因此几乎不可能被黑客入侵。每台计算机都存储了曾经进行过的每笔交易,这些交易被称为节点。当世界上任何地方发生新的加密货币交易时,每个节点都会更新其“公共记录”。由于区块链的去中心化性质,没有一台计算机可以控制数据。

参考:http://symbiosism.com.cn/9644.html;http://www.symbiosism.org

The U.S.-Europe Petrochemical Agreement and the Future of the Global Monetary System

By Archer Hong Qian

Building on the discussion in “From the U.S.-Ukraine Mineral Agreement to the U.S.-Europe Petrochemical Agreement: The President of the United States Faces a Hamlet-like Dilemma—What Should Be Done?”, I would like to focus exclusively on a related issue: the future of the global monetary system.

The U.S.-Europe Petrochemical Agreement: A Key Step in Strengthening the U.S. Dollar’s Reserve Currency Status

The U.S.-Europe Petrochemical Agreement is not only a highly effective expansion of the Trump administration’s energy strategy but also a critical component of fulfilling Trump’s 20 core commitments—specifically, the pledge to “maintain the U.S. dollar’s position as the world’s reserve currency.”

This agreement, covering energy, raw materials, and international settlements, will inevitably have a profound impact on the dollar’s status as the global reserve currency. For decades, oil and commodity transactions have been pillars of U.S. financial dominance. Through this agreement, the United States will reinforce the dollar’s role as the dominant currency in global energy trade, aligning perfectly with Trump’s promise to ensure that the dollar remains at the center of the global financial system.

The U.S.-Europe Petrochemical Agreement and the “De-Dollarization” Myth

In recent years, “de-dollarization” has been sensationalized as a global trend by some countries and media outlets. However, this narrative is an exaggerated fallacy.

The global economy is fundamentally driven by efficiency and trust. At present, the U.S. dollar remains the most liquid, stable, and well-regulated currency in the world.

Even though certain countries experiment with local currency settlements or form regional currency alliances, these measures are primarily aimed at trade convenience and short-term risk hedging rather than any real effort to replace the dollar.

The implementation of the U.S.-Europe Petrochemical Agreement will further prove the dollar’s irreplaceable role in international trade and finance, while weakening the influence of “de-dollarization” rhetoric.

Trump’s commitment to preserving the dollar’s global reserve currency status is not merely about maintaining financial hegemony. Rather, it reflects the dollar’s deep-rooted role as an interactive subject in the global economy.

The dollar is not just a unit of exchange; it is interwoven with global resources, technology, markets, transactions, and regulations. If successfully implemented, the U.S.-Europe Petrochemical Agreement will further entrench the dollar’s central role in global energy pricing and settlements, cementing its function as an irreplaceable stabilizer in the global financial ecosystem.

Super-Sovereign Currency and the Interactive Evolution of the Global Financial System

A decade ago, in my article “On the Philosophical and Economic Foundations of Super-Sovereign Currency—Everything is an Agreement: Symbiotic Rights, Symbiotic Currency, Symbiotic Chain”, I explored the concepts of “Super-National Reserve Currency” and “Super-Sovereign Reserve Currency” as proposed by the Russian government and People’s Bank of China Governor Zhou Xiaochuan on the eve of the 2009 London G20 Summit.

Although these ideas did not materialize into concrete solutions for global economic challenges, they opened a truly thought-provoking question:

As global supply chains, industrial chains, and value chains continue their trend toward interactive symbiosis, the world’s financial rules are gradually shifting toward a “zero-tariff, zero-barrier, zero-discrimination” model. The concept of a super-sovereign reserve currency reflects a highly fair, objective, and interactive global financial demand, possessing great contractual legitimacy and credibility.

Based on this, I propose that all internationally recognized currencies—including digital currencies, cryptocurrencies, and stablecoins—are essentially forms of “Symbiotic Currency” (Symbiotic Token).

This concept not only establishes a new evaluation framework for the future monetary system but also foresees the symbiotic relationships among digital currencies, cryptocurrencies, and stablecoins in the global economy. It highlights the interactive collaboration of different digital assets within shared infrastructure and financial ecosystems.

The Evolution of Digital Currencies, Cryptocurrencies, and Symbiotic Currency

In the blockchain sector, currencies are categorized into native coins and tokens:

✅ Native Coins – Such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), USD Coin (USDC), Ripple (XRP), and TRON (TRX). These serve as the foundational cryptocurrencies of blockchain networks, primarily used for transactions and value storage.

✅ Tokens – Created through smart contracts on existing blockchain platforms, used in specific applications, decentralized finance (DeFi), and the NFT market.

In recent years, global corporations have been integrating cryptocurrency payment systems to enhance transaction efficiency. Additionally, as national regulatory frameworks gradually shift toward “Amorsophia MindsNetworking” (爱之智慧孞態网)—a next-generation trust and ethics infrastructure—the cryptocurrency market is steadily gaining greater stability and legitimacy.

The Role of Symbiotic Currency in the MindsNetworking Infrastructure

As MindsNetworking (孞態网) establishes a new technological and ethical infrastructure, Symbiotic Currency will evolve beyond a mere financial transaction tool—it will also serve as the core mechanism for rewarding and penalizing virtuous or malevolent thought processes.

In this system, Symbiotic Currency will embody the principle of “One Mind Heaven, One Mind Hell”, meaning that:

✅ Virtuous Actions Are Rewarded – Using transparent, traceable mechanisms, actions that promote social symbiosis, technological ethics, and ecological sustainability will be positively incentivized.

✅ Malevolent Thoughts Are Suppressed – A symbiotic credit system, based on collective wisdom evaluation, will hold accountable those who attempt to disrupt social symbiosis, exploit financial systems, or violate technological ethics.

✅ Global Trust Systems Are Optimized – Supported by the MindsNetworking infrastructure, Symbiotic Currency will form a globally open, fair, and credible credit system, facilitating the healthy advancement of human society.

The Future of Symbiotic Currency, Traditional Currency, and the Global Financial System

By recognizing all forms of currency as Symbiotic Currency, we emphasize their interdependence within the global financial system.

✅ The Stability of Traditional International Currencies – The fundamental value of the U.S. dollar, euro, and other fiat currencies lies in their high credit stability and independent governance, ensuring monetary policy stability—which is the bedrock of the dollar’s status as the world’s reserve currency.

✅ The Symbiosis Between Digital and Traditional Currencies – Cryptocurrencies remain pegged to fiat currency valuation, and their stability and liquidity are still influenced by the traditional financial system.

✅ Stablecoins as a Bridge – Stablecoins like Tether (USDT), which are pegged 1:1 to the U.S. dollar, act as stable transaction mediums, promoting integration between traditional finance and digital assets.

✅ The Future of Symbiotic Currency – The global monetary system is moving toward decentralization, diversification, and transparency, where traditional currency, digital currency, stablecoins, and tokens coalesce into an interactive symbiotic value exchange ecosystem.

Conclusion: The U.S.-Europe Petrochemical Agreement as a Catalyst for the Symbiotic Evolution of Global Finance

The implementation of the U.S.-Europe Petrochemical Agreement is not just about maintaining the U.S. dollar’s dominance—it will also accelerate the symbiotic evolution of the global financial system.

More importantly, as MindsNetworking’s technological and ethical infrastructure matures, Symbiotic Currency will transcend its economic function—it will replace many current high-profile trust organizations (such as governments and banks), becoming a reliable medium for supervising and advancing Love Wisdom, social justice, technological ethics, and the global symbiotic way of life.

March 9, 2025 – Late Night, Vancouver

钱 宏主编:《全球共生:化解冲突重建世界秩序的中国学派》Global Symbiosism: Chinese School of Defusing Clashes and Rebuilding the World Order,台湾晨星出版社,2018

作者联系方式:Hongguanworld@gmail.com;+1 604 690 6088

您好!请登录

已有0评论

购物盒子